On October 10, the statistics agency IDC released the report on PC shipments in the third quarter of 2022. Compared with the same period last year, PC shipments decreased by 15%. In this quarter, global shipments totaled 74.3 million units, down from 87.3 million units in the same period last year. On the same day, data from Gartner Inc., another research company, showed that global shipments in the third quarter fell 19.5% year on year, the largest drop in more than 20 years.

Lu Zhongyuan, president of SK Hynix (general manager), said: "Based on our ability to turn crisis into opportunity in the past history, we will overcome this downturn and become a real storage leader."

With the end of the buying boom of consumer electronic equipment since the epidemic, manufacturers providing advanced processors and memory chips began to face the impact, and PC shipments were declining at the fastest rate in decades.

SK Hynix said that in the future, it will focus on products with low profitability to reduce production. That is to say, in a certain period of time, it will maintain the tone of investment reduction and production reduction, so that the supply and demand balance of the market will return to normal.

At the same time, SK Hynix predicts that the oversupply will continue for some time. Therefore, the company decided to reduce the investment scale of next year from 15 trillion won to 20 trillion won this year to more than 50%.

Sanjay Mehrotra, CEO of Micron, said frankly that customers from all walks of life were cutting orders and reducing the chip inventory they had previously hoarded. At present, the chip industry is "in a difficult situation" in terms of pricing. Mehrotra also said that the future demand for memory chips and the company's operation will face more serious difficulties. Therefore, the company will cut its investment plan, including reducing the capital expenditure of wafer factory equipment by nearly 50% compared with last year.

In addition, the company added, "The company developed 238 layers of 4D NAND for the first time in the industry in the third quarter of this year, and will expand the production scale next year to ensure cost competitiveness and continue to improve profitability."

Hynix is not the only chip manufacturer that feels cold. At the end of last month, Micron, an American memory manufacturer, released a bleak Q4 financial report for fiscal year 2022 (as of September 1, 2022) and an annual financial report for fiscal year 2022, and expressed an unusually pessimistic expectation for the next fiscal quarter. Samsung has also repeatedly warned recently that as the demand for personal computers and smartphones has further weakened than expected, leading to data center and consumer technology customers cutting orders and increasing inventory, the company is facing a more severe market situation. The preliminary performance report of Samsung Electronics shows that the operating profit in the third quarter was 10.8 trillion won, down 32% from 15.8 trillion won in the same period last year, the first year-on-year decline in nearly three years.

SK Hynix analyzed that due to the downturn of the global macroeconomic environment, the demand for DRAM and NAND products was sluggish, the sales volume and price declined , and the sales volume in the third quarter also decreased year on year. In addition, the company also said that although it improved the sales proportion and yield of the fourth generation (1a) DRAM and 176 layer 4D NAND of the latest process 10nm and improved cost competitiveness, the price reduction was greater than the cost savings, and the operating profit was also significantly reduced.

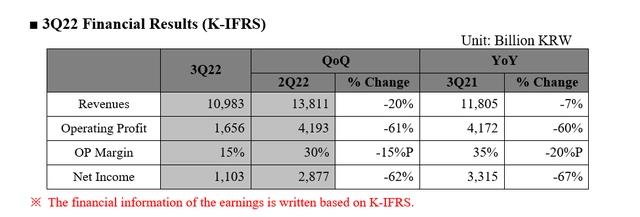

· Combined with revenue of 10.9829 trillion won, operating profit of 1.6556 trillion won and net profit of 1.1027 trillion won .

· Sales and profit declined on a month on month basis due to the decline in storage demand and price.

· Next year's investment scale will be reduced to more than half of this year's, and production will be reduced around products with low profitability.

In recent months, Hynix's share price has fallen 27% this year due to soaring inflation and higher interest rates forcing consumers and corporate customers to cut spending and sharply cooling global chip demand.

On October 26, 2022, SK Hynix released its financial report for the third quarter of fiscal year 2022 as of September 30, 2022. In the third quarter of fiscal year 2022, the combined revenue of the Company was 10.9829 trillion won, the operating profit was 1.6556 trillion won, and the net profit was 1.1027 trillion won. In the third quarter of fiscal year 2022, the operating profit margin is 15% and the net profit margin is 10%. In the third quarter of fiscal year 2022, combined revenue decreased by 20.5% month on month and operating profit decreased by 60.5% month on month.

In order to cope with the cold winter of the industry, Hynix said that it would gradually reduce the production of products with relatively low profit margins, and redistribute the plant equipment and product portfolio to improve the long-term efficiency of the plant operation. In addition, Hynix predicts that the industry will continue to oversupply in the short term. Considering this, the company decided to reduce its capital expenditure by more than 50% next year compared with this year. This year's investment is expected to reach the upper limit of the 10 trillion - 20 trillion won range.