For years, the global semiconductor supply chain focused on one main goal: efficiency. Companies optimized costs, minimized inventories, and relied on just-in-time delivery to keep operations smooth. But in 2026, the rules are changing. Geopolitical factors, regulatory compliance, and supply chain resilience are now critical to success.

For engineers and procurement teams working with Perceptive, this means sourcing decisions go beyond price and lead time. Chips are no longer just products—they are strategic assets that require careful attention to where they are designed, manufactured, and shipped.

The Shift from Country of Origin to Country of Design

Tracking Country of Origin (COO) was once enough to manage tariffs and customs. Today, however, regulators increasingly look at Country of Design (COD) to protect sensitive technology. Even if a chip is packaged or assembled in a neutral region like Southeast Asia or India, it may face export limits if its core IP or design tools come from restricted jurisdictions.

This shift has fragmented the market into separate technology ecosystems. At Perceptive, we are helping clients track every component's "ancestry" to make sure sourcing decisions stay compliant and uninterrupted.

2026 Market Overview

According to the latest industry forecasts, the global semiconductor market is expected to approach $1 trillion in 2026, reflecting strong growth driven by AI and data center demand. But this growth masks real supply challenges:

High-end AI components vs. mature-node chips: Advanced GPUs and memory modules see huge demand, while 28nm–90nm chips, still essential for automotive and industrial applications, face uneven availability. Regional policies and production priorities have created both localized oversupply and critical shortages.

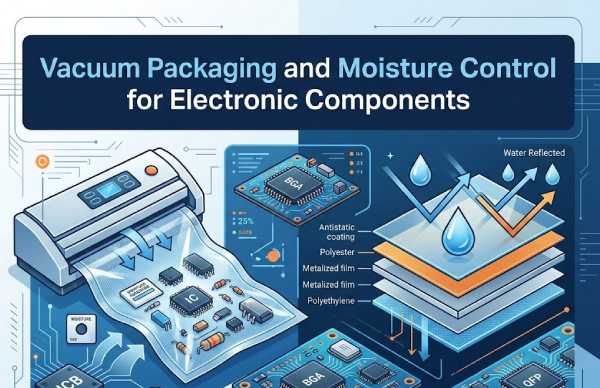

Critical materials and secondary sourcing: Restrictions on materials like gallium, germanium, and graphite have led manufacturers to prioritize recycling and circular supply chains. While this improves material security, it increases reliance on secondary markets, requiring rigorous quality checks to avoid counterfeit or degraded parts.

Geopolitical Realities in Sourcing

Several large semiconductor firms have split operations across regions to meet different regulatory requirements. This has created two main sourcing realities:

Geopolitically clean inventories: Chips designed and sourced to meet strict compliance standards are in high demand for aerospace, defense, and critical infrastructure. These components often come at a premium but offer protection against sudden trade restrictions.

Neutral manufacturing hubs: Countries like Vietnam, Malaysia, and India continue to serve as key buffers. However, as their importance grows, so does regulatory scrutiny. Perceptive works closely with suppliers to ensure transparency and reliable documentation for all sourced components.

Strategic Outlook

In 2026, the most pressing supply challenge is not production capacity, but compliance. Chips exist, but the legal ability to move them across borders is increasingly complex. The companies that succeed will be those with flexible sourcing strategies, diversified suppliers, and clear visibility into every tier of their supply chain.

Perceptive helps procurement teams navigate these complexities, providing expertise in component traceability, supplier auditing, and sourcing across multiple regions. Our goal is to turn potential disruptions into manageable risk and maintain smooth operations for our clients.

Conclusion

The semiconductor supply chain is changing fast. As markets expand, geopolitical and regulatory friction will remain a constant factor. For Perceptive partners, the key to success is not only understanding these changes but using them to strengthen supply chain resilience, ensure compliance, and keep production running smoothly.