If the chip is viewed as a complete "jigsaw" puzzle, this "jigsaw" consists of many small "puzzle pieces", each of which is critical. "Each small piece of the puzzle is critical, and once a problem occurs, it can cause the entire product to become obsolete. These puzzle pieces are many and varied, ranging from revenue to semiconductor product subcomponents such as foundry technology, packaging, substrate or leadframe selection, test platforms, and design resources.

In addition, these "puzzle pieces" include the overall strategic direction or market focus of the semiconductor company. While a semiconductor company's market focus may change over time, the product focus of a longtime system house (e.g., a customer) may not change as easily. Therefore, when evaluating the long-term supply risk posed by product selection, it is important to realize that the part number information provided by the original component manufacturer (OCM) covers much more than what can be covered by the bill of materials (BOM) health reports provided by commercial tools.

How does the manufacturing supply chain affect long-term product availability?

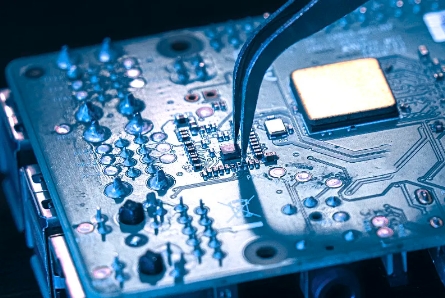

Most traditional semiconductor products have been packaged in leadframe package formats such as DIP, PLCC, QFP, and PGA. Today's semiconductor market has moved away from leadframe packages as the primary yield driver and is gradually shifting to substrate-based assembly.

Reasons why the industry is moving away from leadframe assemblies

To gain a deeper understanding of the reasons for the gradual disappearance of leadframe assemblies, we need to take a comprehensive look at the history of the assembly base, changes in profitability, and industry trends.

As early as the 1980s, the trend of offshore outsourcing was already on the rise. At that time, TSMC had yet to make a name for itself in the semiconductor industry with its superior foundry technology. Offshore assembly was driven primarily by cost factors, but also by environmental constraints, as the assembly process was not as clean as it is today. As the industry became increasingly competitive, numerous leadframe suppliers were gradually eliminated from the competition, and only the largest suppliers were able to eke out a profit. Today, leadframe margins have fallen into the single digits, while most semiconductor companies have margins approaching 50 percent.

In the 1990s and early 2000s, leadframe component production reached an all-time high, driven by high-speed IO (input/output) and BGA (solder ball array package) assembly. The advent of high-speed IO standards, such as PCI-e, multi-gigabit Ethernet, SATA, and SAS, has brought to light a significant challenge: traditional wire bonding technology is becoming a bottleneck in achieving the full potential of these standards. While high-speed IO standards and other emerging standards have clearly defined performance roadmaps, wire bonding technology is struggling to keep pace with these ever-increasing demands.

At the same time, as device speeds increase dramatically, so does their power consumption. Lead bonding distributes power from the outside of the chip to the core, but for the high-performance products that became commonplace in the 1990s, power from the outside of the chip alone was not enough to meet the growing demand for power.

Flip-chip and BGA package substrates were developed to address this challenge, and these technologies effectively alleviate the power distribution challenge by eliminating the reliance on lead bonding by supplying power directly to the core. This solution not only improved power transfer efficiency, but also achieved better signal integrity, enabling devices to comply with high-speed SerDes (Serializer/Deserializer) standards.

In the early 21st century, as production of leadframe assemblies dwindled, a new low-pin-count package, the QFN package, emerged as a substrate-based assembly that uses lead bonding technology to attach chips to leads. The emergence of this type of package signaled the development of semiconductor packaging technology in a more efficient and advanced direction.

To this day, substrate assemblies have far surpassed leadframe assemblies in terms of production volume. Previously, trimming and molding tools were the most costly leadframe processing equipment for packaging plants. As leadframe assembly production shrinks, substrate-based assembly becomes mainstream. Packaging plant from the lead frame assembly conversion to the substrate assembly, need to change the trimming and molding tools, and their profit margins are only single-digit, the profitability is difficult to support the complete abandonment of the lead frame assembly.

The industry has chosen to abandon the leadframe assembly, because the technical performance requirements of zero-wire bonding, and continue to produce low-volume leadframe assembly cost is too high. This is not only for economic reasons, but also as a natural consequence of technological advances.

Once the assembly program is finalized, the test program has to be adjusted right along with it. Pay close attention to similar trends in test technology to ensure a smooth transition to substrate assembly testing. If there is a lack of convergence in the substrate assembly test, it may lead to the problem of technology lagging behind. Currently, the latest production test equipment on the market primarily serves substrate-based assembly, and all measures aimed at reducing the cost of mass production are primarily centered around substrate components.

It is worth noting, however, that as production volumes gradually decrease, OSAT (outsourced semiconductor packaging and test) factories are facing increasing challenges when testing for low-volume production. This challenge is especially evident in those products that are leadframe based.

Acquisition of OSAT's supply chain alone will not meet customers' long-term needs

With an abundant supply of wafers, is it sustainable for a company to provide the same semiconductor product to its customers by only acquiring the existing OSAT supply chain?

Rochester Electronics believes this option is only a short-term stopgap. Recall that the "puzzle pieces" mentioned earlier encompass everything from leadframes to assembly to test. In an OSAT supply chain, as soon as a segment no longer appears to be economically viable, it is likely to be eliminated. This is because any company that supports OSAT supply chain management is unable to drive mass production of its products, which increases the risk of technology obsolescence. As a result, OSAT vendors are unable to utilize the same level of product continuity as original component manufacturers (OCMs). In the short term, OSAT supply chain management may be able to sustain product production, but it is not sustainable in the long term.

Partnering with an authorized semiconductor manufacturer can effectively reduce the risk associated with component obsolescence or discontinuation. When a component is discontinued, the licensed manufacturer is able to continue to produce those devices that are no longer supplied by OCM. At this point, the OCM transfers the remaining wafers, bare cores, assembly processes, and original test intellectual property (IP) to the licensed manufacturer. This means that even components that were previously discontinued can now be remanufactured with full compliance to the original specifications. Even more conveniently, this partnership eliminates the need for additional qualifications or software changes, thus greatly simplifying the manufacturing process.

————————

About Perceptive Components Limited

We are one of the world's leading distributors of semiconductor and electronic components. With 21 years of business experience in the electronic components industry, we have in-depth cooperative relations with thousands of brand manufacturers and agents, focusing on TI, Microchip, NXP, Infineon, Intel, onsemi, ST, Micron.

To learn more about Perceptive, visit perceptive-ic.com.