Recently, Arm's board of directors is preparing for the IPO, appointing former Qualcomm CEO Jacobs and former Intel executive Schuller as company directors.

The ex-Qualcomm CEO has joined Arm's board of directors as ARM is headed for an IPO .

ARM is the world's leading semiconductor intellectual property (IP) provider.

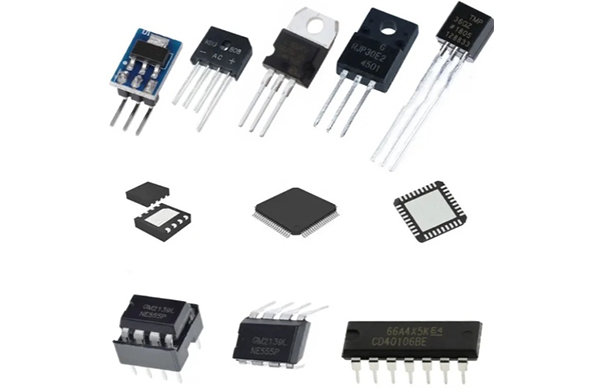

And why can a chip company that doesn't make a single chip conquer the global chip market? ARM is small and complete. There are 4,000 people in the company, distributed in the processor department, media department (graphics processor, video and display module) , system IP and software department (bus, interrupt controller, MMU, memory controller). Now that the global semiconductor market has dropped to US$580 billion, if the X86 architecture has almost dominated the entire PC era and the server market, then the ARM architecture dominates the world in the embedded and mobile terminal fields. SiFive's newly appointed CEO, Patrick Little, a former Qualcomm executive, also previously believed that Nvidia's $40 billion deal to acquire Arm had aroused customer interest in SiFive.

But on the other hand, the ARM route is still difficult to realize the dream of independent CPU.

ARM has said that ARM's listing in London will be delayed until later in 2023 because the company's management is worried that the global economic downturn and the plunge in technology stocks may scare off potential investors.

In addition, ARM's third largest CPU architecture, RISC-V, is not enough to replace x86.

At least in terms of high performance,

ARM's development is far from enough.

A few days ago, Arm was exposed to take risks.

On the eve of IPO, it broke face with Qualcomm, went to court, and its former partners became rivals. ARM will therefore plan to change the licensing model. The relationship between the two companies is so delicate?

1. At present, in the field of mobile phone SOC, the specifications adopted by the bottom layer are all ARM. Qualcomm CEO said: Hope to invest in Arm together with other chip manufacturers. The reason why Qualcomm hopes to take a stake in ARM together with competitors is to eliminate concerns about ARM's control.

2. In addition, the designate CEO of Qualcomm also stated that if Softbank considers listing Arm instead of selling it to Nvidia, they are willing to invest.

As early as 2013, there was turmoil at the top of the chip giant, and ARM appointed a new CEO to challenge Intel.

In 2018, the start-up company Ampere, a former executive of Intel, also released the ARM-based server chip eMAG, challenging its old company. At the beginning of this year, Intel CEO once said that he intends to form a consortium to buy ARM; in October, Arm announced the new board members and new chief financial officer. Subsequently, Qualcomm released ARM chips to challenge Intel in cloud data centers. At the same time, Arm was revealed to be preparing for the IPO in a "big change", and the executive team and organizational structure were deeply adjusted; while Sun Zhengyi's last big bet was to bet on the most important IPO comeback in chip history.