It is reported that the world's second largest automotive semiconductor supplier, Japan's Renesas car company, has recently seized the "chip" track and calmly dealt with the shortage or surplus of automotive chips.

Renesas Electronics also said: To deploy the most complete functions in the market, the accumulation should be faster than the world.

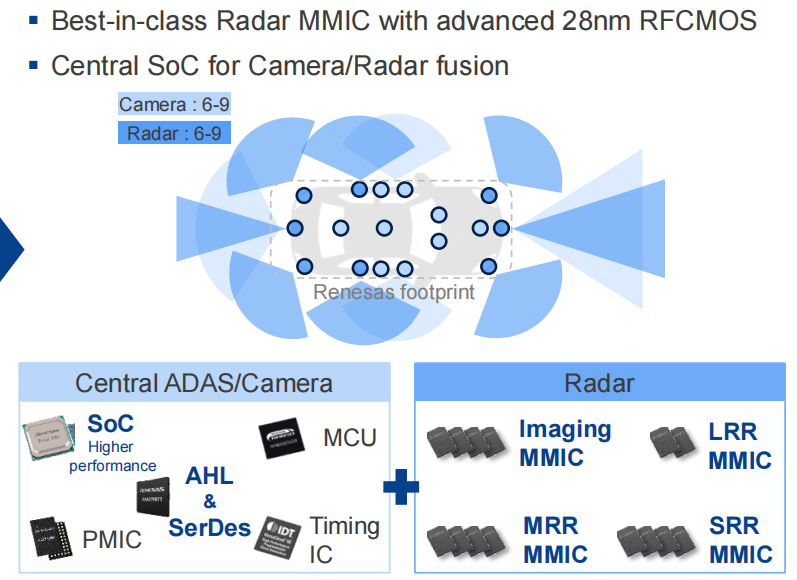

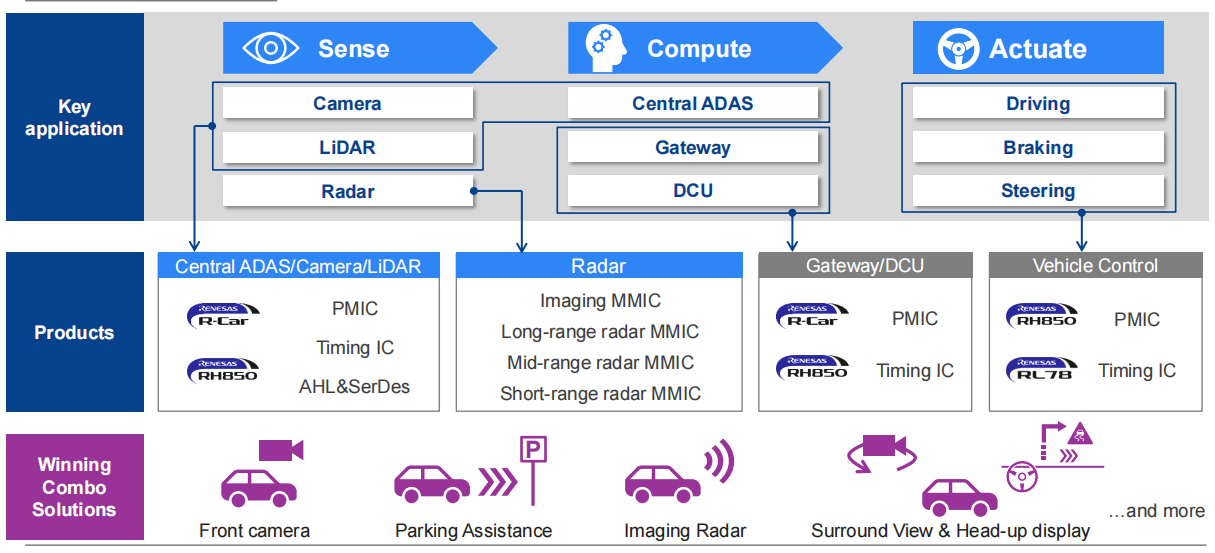

In addition, Renesas unveiled a variety of advanced automotive electronics solutions at the 2022 Munich South China Electronics Show a few days ago, seizing an excellent opportunity.

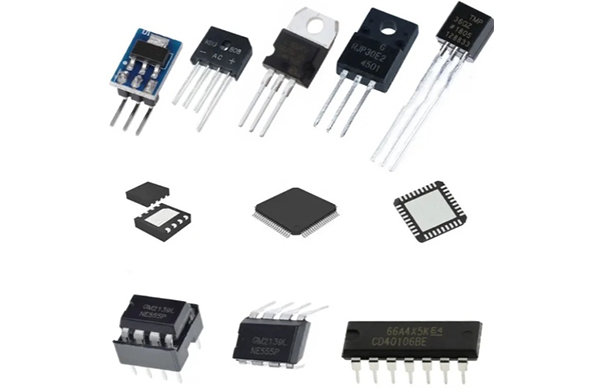

Automotive electronics can be divided into MCU, power semiconductors, sensors and other chips.

In this context, accelerating the layout of the industrial field and introducing the RISC-V chip architecture is the best measure for Renesas to insist on a multi-faceted attack in the near future.

As a Japanese chip giant, Renesas has accepted many exclusive interviews and believes that the role of car companies is becoming more and more important in the current era.

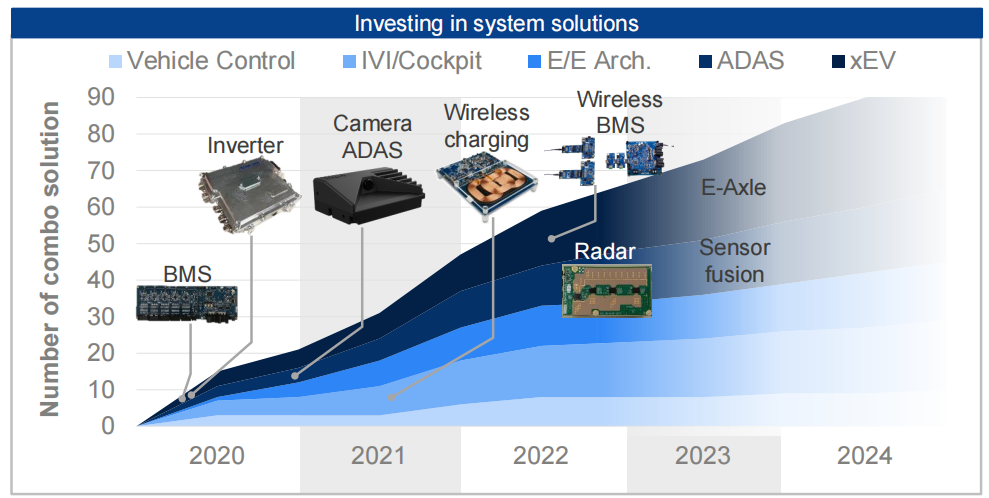

As early as March 2017, the demand for automotive semiconductors was soaring. At that time, Renesas decisively "bet" on new energy vehicles and autonomous driving, focusing on smart cars , and continued to achieve strong growth. And in 2017, all major giants have made big moves to seize the new heights of automotive electronics. By September 2018, there was a wave of mergers and acquisitions in automotive semiconductors, and major giants were vying for the best position; at that time, large-scale mergers and acquisitions struck, and unmanned vehicles became a new battlefield in the chip industry. Internet market.

In 2021, Renesas Electronics saw through the nature of the market at that time: the involvement of automakers in the supply chain has both advantages and disadvantages for semiconductor companies.

As of today, Renesas Electronics announced that it will spend $6.7 billion to acquire San Jose chipmaker Integrated Device Technology (IDT), in part to prepare for self-driving cars.

· A few days ago, the CEO of Renesas Electronics also predicted that the shortage of automotive chips will ease in mid-2023; and the shortage of automotive chips will continue until the second half of 2021.

· Today, when automotive semiconductors are competing for leadership, will 2023 be a turning point for automotive chip shortages?

· Obviously, the global auto market is now in decline, and Renesas Electronics has successfully driven new growth points with two "black technologies".

· In addition, Renesas is also optimistic about the growth of semiconductors for a long time, and continues to deploy the four cornerstone areas of automobile, industry, infrastructure and IOT.

This is undoubtedly a good sign for Renesas' expectations for the future.

On the other hand, Renesas Electronics' attitude towards the current situation of core shortage is: there is no need to increase production capacity, and it should strengthen its own production capacity combined with outsourcing to create flexible supply.

·

In May of this year, Renesas invested $700 million to double power semiconductor production.

·

Then it provided a new generation of power semiconductors to many electric vehicle companies.

·

In 2020, CCID made a prediction on the current situation of chips: in-vehicle chips will usher in a multi-competitive landscape.

·

And Renesas has dealt with this pattern well.

In the future, Renesas will continue to carefully lay out the core "core" track, and make perfect use of market opportunities to complete the development and upgrading of its own enterprise.